Table of Contents

- 29% of Californians say inflation is no hardship. Who are these people ...

- Southern California inflation rises 2.5%, highest in 6 years – Orange ...

- Can California’s next governor fix the state’s problems? It depends on ...

- Progress on the Inflation Front, and Can We Avert Stagflation ...

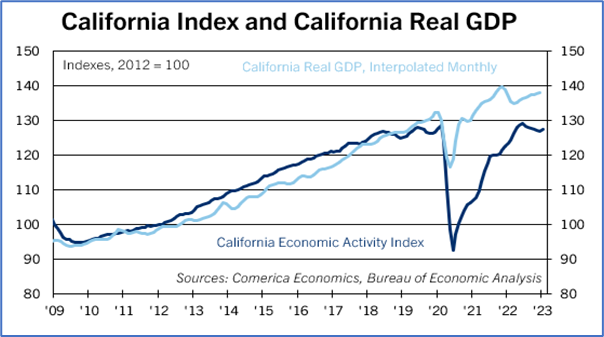

- Comerica Bank's California Index's Decline Moderated in January | Comerica

- California Inflation Relief Check: when will I receive the payment ...

- California Inflation Relief Check: when will I receive the payment ...

- 23 Million California Residents to Receive up to ,050 in Inflation ...

- Inflation continues to rise in California. Here’s what economists say ...

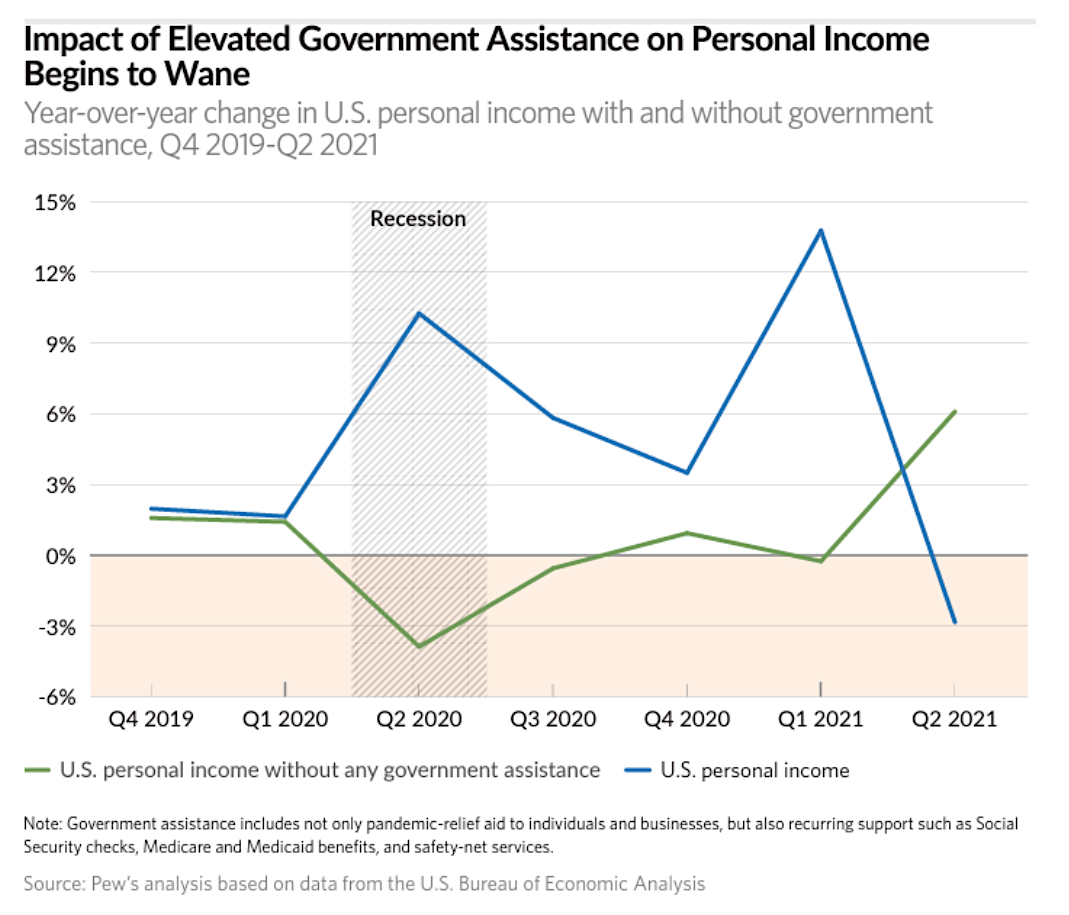

- California Only State Where Personal Income Rose Above Inflation Since ...

Historical Inflation Rates: 2000-2020

The following table highlights the annual inflation rates in the US from 2000 to 2020:

| Year | Inflation Rate |

|---|---|

| 2000 | 3.4% |

| 2001 | 2.8% |

| 2002 | 1.6% |

| 2003 | 2.3% |

| 2004 | 3.3% |

| 2005 | 3.4% |

| 2006 | 3.2% |

| 2007 | 2.9% |

| 2008 | 3.8% |

| 2009 | -0.4% |

| 2010 | 1.6% |

| 2011 | 3.0% |

| 2012 | 2.1% |

| 2013 | 1.5% |

| 2014 | 0.8% |

| 2015 | 0.1% |

| 2016 | 2.1% |

| 2017 | 2.1% |

| 2018 | 2.4% |

| 2019 | 2.3% |

| 2020 | 1.2% |

Projected Inflation Rates: 2021-2025

Using a US inflation calculator can help individuals and businesses make informed decisions about investments, savings, and pricing. By understanding the current and projected inflation rates, you can better navigate the economy and make smart financial choices.

In conclusion, understanding the current US inflation rates from 2000 to 2025 is crucial for making informed financial decisions. By analyzing historical data and projected trends, individuals and businesses can better navigate the economy and make smart choices about investments, savings, and pricing. Whether you're a consumer, investor, or business owner, using a US inflation calculator can help you stay ahead of the curve and achieve your financial goals.Stay up-to-date with the latest inflation trends and forecasts, and use the valuable insights and tools provided in this article to make informed decisions about your financial future.